Payback Period Advantages and Disadvantages Top Examples

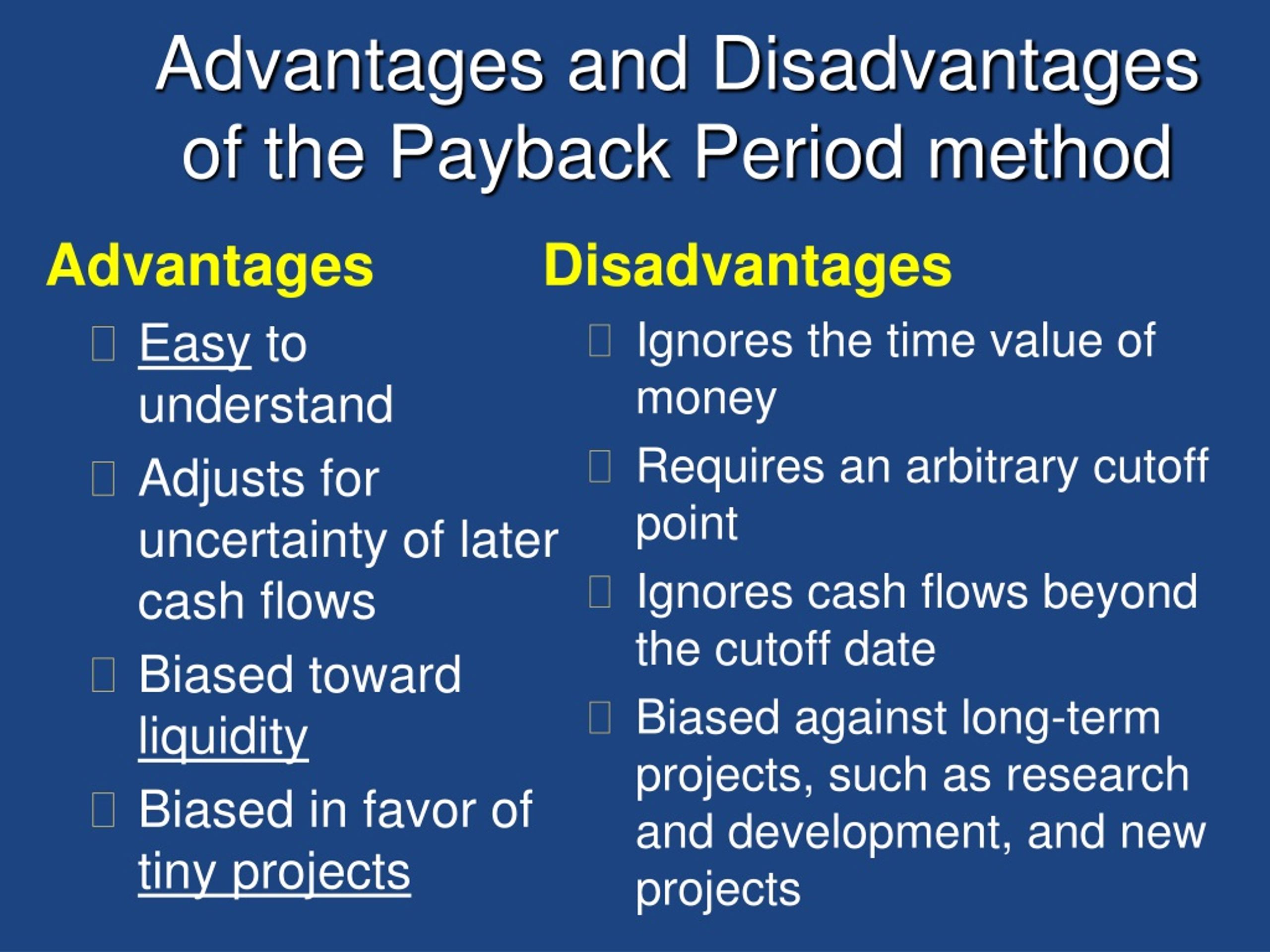

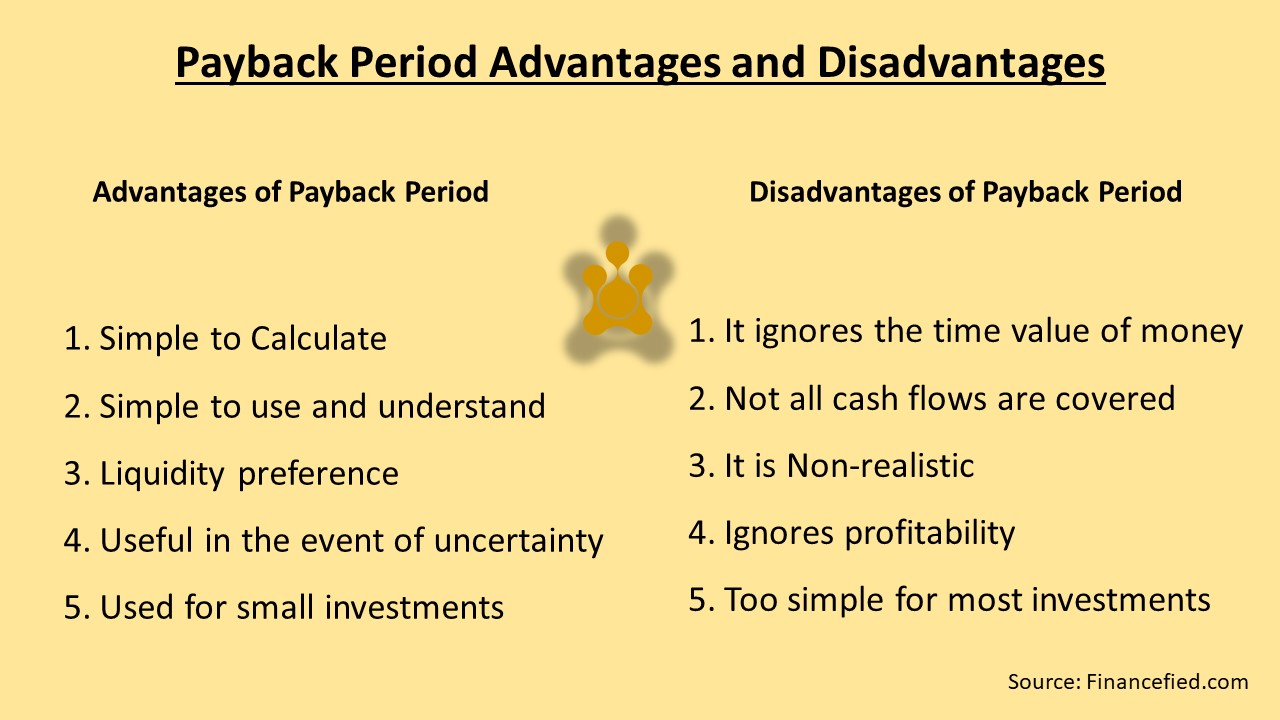

Advantages of Payback Period. 1. Simple to calculate: The payback period is straightforward and easy to calculate. It involves simple arithmetic as you only need to divide the initial investment by the annual cash inflow. 2. Useful measure of risk: The payback period provide a good measure of the risk associated with a project.

ADVANTAGES AND DISADVANTAGES OF PAYBACK PERIOD METHOD YouTube

The main advantages of payback period are as follows: A longer payback period indicates capital is tied up. Focus on early payback can enhance liquidity Investment risk can be assessed through payback method Shorter term forecasts This is more reliable technique The calculation process is quicker than and simple than any other appraisal techniques

Payback Period Advantages and Disadvantages Techniques of Capital Budgeting

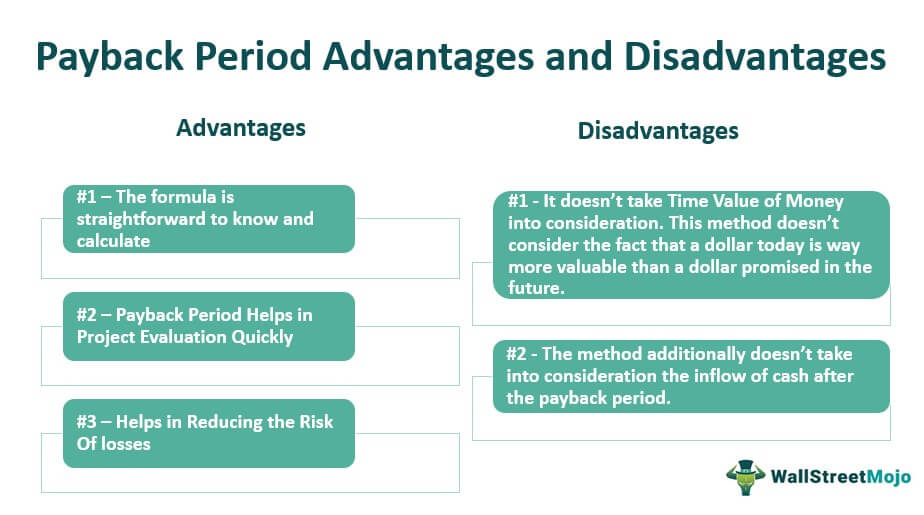

Payback period advantages include the fact that it is very simple method to calculate the period required and because of its simplicity it does not involve much complexity and helps to analyze the reliability of project and disadvantages of payback period includes the fact that it completely ignores the time value of money, fails to depict the d.

Discounted Payback Period Definition, Formula, Benefits eFM

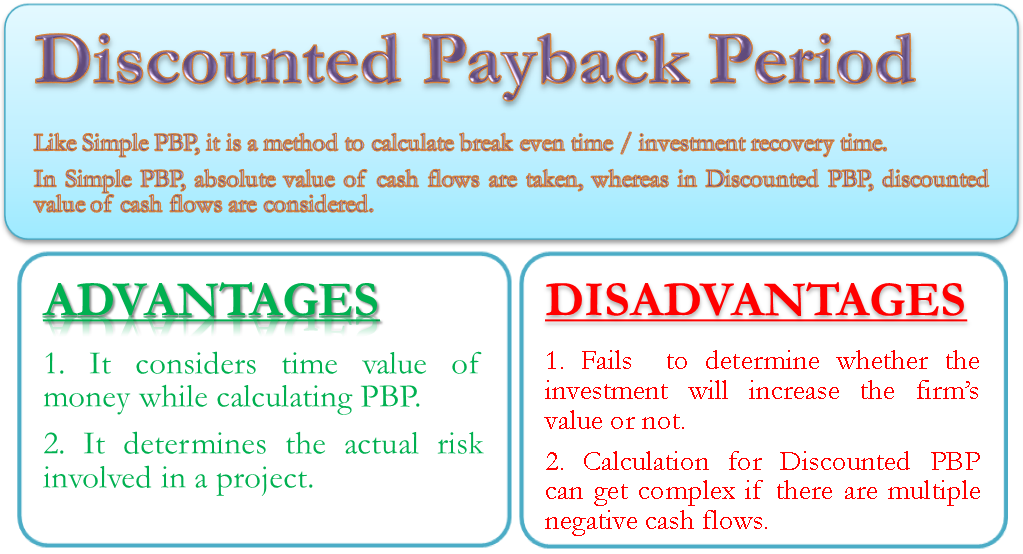

Advantages Disadvantages Conclusion Discounted Cash Inflow = Actual cash inflow / (1 + i) n Here, it refers to the discount rate, and n refers to the period for which the cash inflow relates In the next step, we calculate the discounted payback period using the following formula: Discounted Payback Period = A + B / C Here,

PPT Valuation Methods & Capital Budgeting PowerPoint Presentation ID261165

Pay-back Period Method: PBP, Advantages & Disadvantages Business Studies Managerial Economics Pay-back Period Method Pay-back Period Method Dive into the world of business studies with a comprehensive exploration of the Pay-back Period Method.

Advantages And Disadvantages Of Payback Period Pdf Otosection

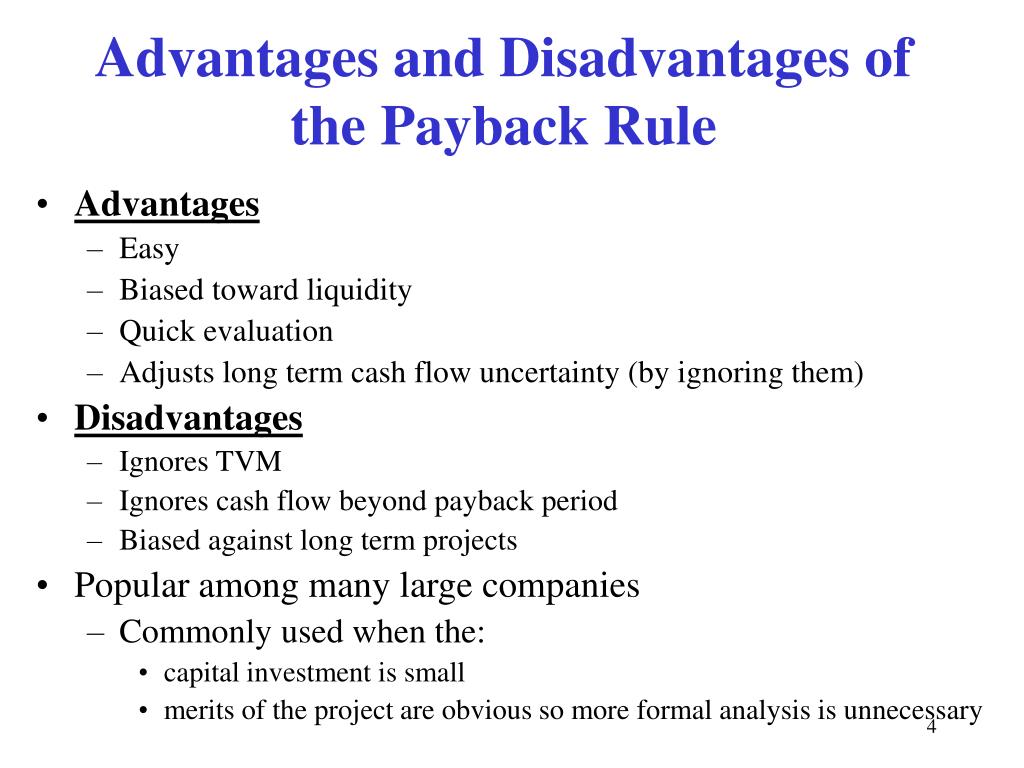

The most significant advantage of the payback method is its simplicity. It's an easy way to compare several projects and then to take the project that has the shortest payback time. However,.

Advantages and Disadvantages of Payback Period

The payback period (PBP) is an investment appraisal technique that tells the amount of time taken by the investment to recover the initial investment or princip. Read Advantages and Disadvantages of Payback Period for a more detailed article. Discounted Payback Period.

Advantages and Disadvantages of Payback Period

Disadvantages of Payback Period. 1. It ignores the time value of money. By the time value of money, I mean considering inflation and its impact on currency purchasing power. The payback period completely disregards that fact and only focuses on the period it takes to return the investments.

Payback Period Business tutor2u

The principal advantage of the payback period method is its simplicity. It can be calculated quickly and easily. It is easy for managers who have little finance training to understand. The payback measure provides information about how long funds will be tied up in a project.

Chap006

1. It Is a Simple Process. One of the biggest advantages of using the payback period method is the simplicity of it. You base your decision on how quickly an investment is going to pay itself back, and that is done through forecasted cash flow.

PPT Net Present Value and Other Investment Criteria Chapter 9 PowerPoint Presentation ID8785519

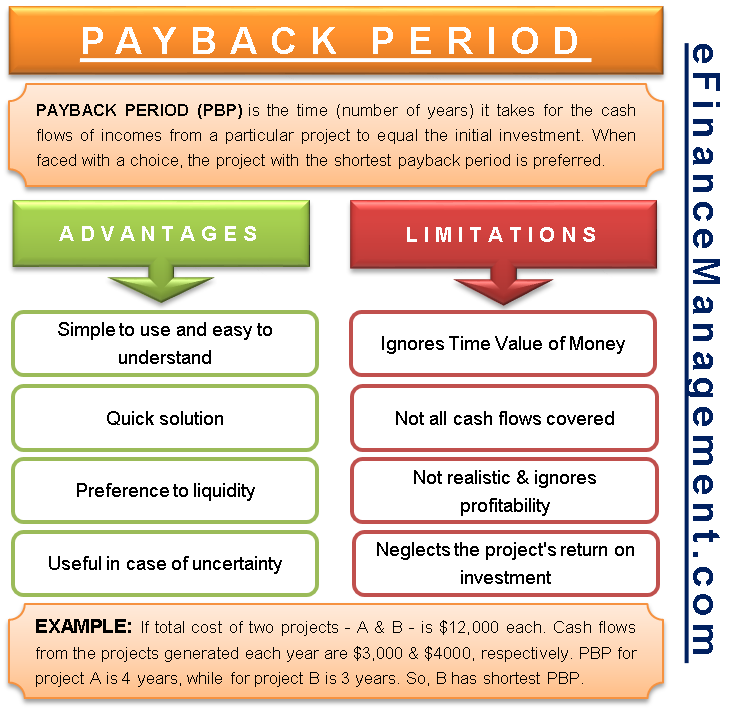

Conclusion Frequently Asked Questions (FAQs) For instance, if the total cost of two projects - A and B - is $12,000 each. But, the cash flows of income of both the projects generate each year are $3,000 and $4000, respectively. The payback period for project A is four years, while for project B is three years.

Advantages and disadvantages of payback period pdf

Financial Analysis Use for Small Investments The payback period is especially useful for a business that tends to make relatively small investments, and so does not need to engage in more complex calculations that take other factors into account, such as discount rates and the impact on throughput. Simplicity

Payback Period Advantages and Disadvantages Financefied

Solution: Since the annual cash inflow is even in this project, we can simply divide the initial investment by the annual cash inflow to compute the payback period. It is shown below: Payback period = $25,000/$10,000 = 2.5 years

Payback Period Method Meaning, Formula, Calculations, Advantages & Disadvantages

Advantages of the Payback Method Payback period as a tool of analysis is easy to apply and easy to understand, yet effective in measuring investment risk. LEARNING OBJECTIVE Describe the advantages of using the payback method KEY POINTS

What Are Some Advantages, Disadvantages And Limitations Of The Payback Period?

1 Advantages of payback period 2 Disadvantages of payback period 3 Alternatives to payback period 4 How to use payback period effectively 5 Here's what else to consider The.

Disadvantages and Advantages of Payback Period eFinanceManagement

It helps evaluate liquidity risk - projects with shorter payback have less risk as the initial investment is recovered quicker. It is used to compare projects - projects can be ranked by payback period for capital rationing decisions. It is easy to calculate with limited data